This article breaks down what off-exchange plans are, who they’re best suited for, their pros and cons, and which insurers offer them.

What Are Off-Exchange Health Plans?

Off-exchange health plans are individual health insurance policies that you purchase directly from a private insurance company or through a broker, rather than through a government-run exchange. They must still comply with Affordable Care Act (ACA) regulations, meaning they cover essential health benefits and can’t deny coverage for pre-existing conditions.

The biggest difference? Off-exchange plans do not qualify for premium subsidies or cost-sharing reductions, even if the plan is nearly identical to one sold on the exchange.

Who Are Off-Exchange Plans For?

Off-exchange plans appeal to a specific subset of the population:

- High-Income Individuals or Families

Those who earn too much to qualify for subsidies under the ACA often explore off-exchange plans that offer more flexibility, broader networks, or extra features. - Pre-Medicare Adults (Ages 50–64)

This group frequently buys individual insurance and may prefer off-exchange plans with access to preferred hospitals or doctors. - Self-Employed Professionals or Entrepreneurs

People without employer-sponsored insurance but who want more control over their provider choices often explore off-exchange options. - People with Specific Provider Needs

Some plans available off-exchange include broader networks, covering specialists or facilities not available through marketplace options.

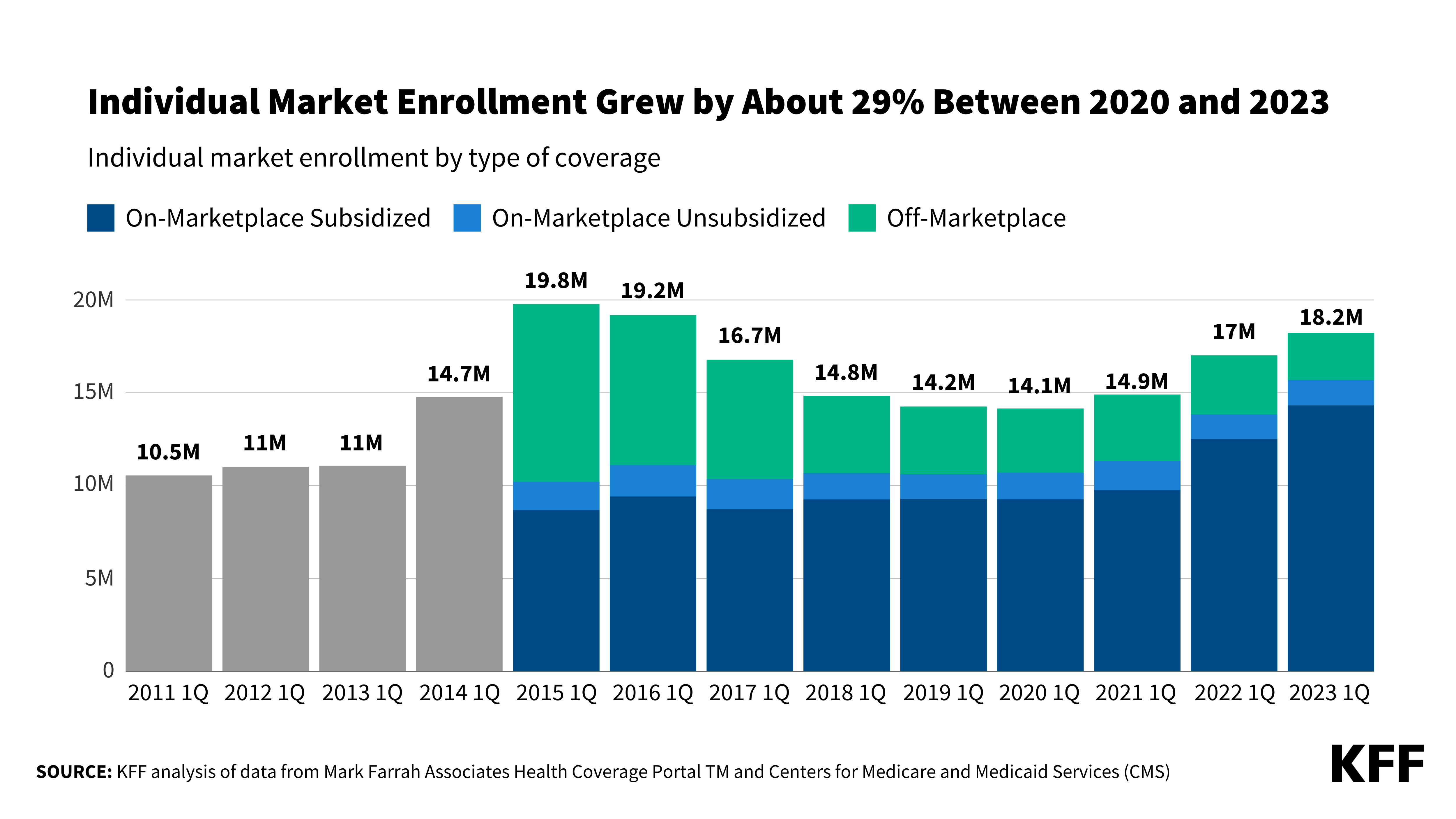

How Common Are Off-Exchange Plans?

According to data from the Kaiser Family Foundation (KFF) and CMS, roughly 4 to 5 million people—about 5–7% of those in the individual market—are enrolled in off-exchange plans as of recent years. While the majority still enroll through the exchange to take advantage of subsidies, off-exchange enrollment has remained steady, especially among higher-income households.

Pros and Cons of Off-Exchange Plans

✅ Pros

- More Plan Options: Some insurers offer plans off-exchange that aren’t available through Healthcare.gov or state exchanges.

- Broader Provider Networks: Off-exchange plans may include more doctors, specialists, and hospitals.

- More Privacy: You don’t need to submit tax or income information to the government.

- Direct Customer Service: You work directly with the insurer, which may result in quicker assistance or claims processing.

❌ Cons

- No Subsidies: If you’re eligible for ACA premium tax credits, you must buy a plan through the exchange to get them.

- Same Rules, Higher Price: Off-exchange plans still follow ACA rules, so if you don’t get subsidies, they can be expensive.

- Confusing Choices: Without the structure of the marketplace, comparing plans can be more complex.

Popular Providers That Offer Off-Exchange Plans

Several major insurers offer both on- and off-exchange options. Availability varies by state, but common providers include:

- Blue Cross Blue Shield (various affiliates)

- UnitedHealthcare

- Cigna

- Kaiser Permanente

- Molina Healthcare (in select regions)

- Oscar Health

It’s important to compare both on- and off-exchange offerings in your area to see what’s best for your needs and budget.

Final Thoughts

Off-exchange health plans offer greater flexibility and access, but they come at a price—literally. If you qualify for subsidies, you’re almost always better off using the Health Insurance Marketplace. But for those who don’t qualify or who want broader provider access, off-exchange coverage can be a strong alternative.

Always compare your options, and consider speaking with a licensed insurance agent who can help you navigate both markets.

Sources & References